Buzz Explodes the Wealth Effect: A Comprehensive Inventory of DeFI Race Track Projects

DeFAI, short for DeFi + AI, simplifies the complex DeFi interface and operations through AI technology, reducing the entry barriers for the general public and making DeFi more accessible. DeFAI has built a grand vision—in the future, through AI Agents and various AI-powered platforms, managing one's investment portfolio will be as simple as chatting with ChatGPT, allowing everyone to easily participate in decentralized market trading.

Currently, the DEFAI projects on the market can be roughly divided into three categories: Assistant category, aiming to simplify operations; Trading category, assisting in investment decisions; dApps category, building ecosystems. Below, the author will outline each project in each category.

Assistant Category

Prior to AI, "intent narrative" has always been trying to simplify the use of DeFi platforms. Platforms like CoWSwap and symm io allow users to obtain the best pricing in fragmented liquidity pools, addressing liquidity fragmentation issues. However, they did not solve the core issue: DeFi still feels difficult.

Currently, AI-driven solutions are bridging this gap, where users only need to express their intent, and the AI agent can directly execute the instructions.

griffain

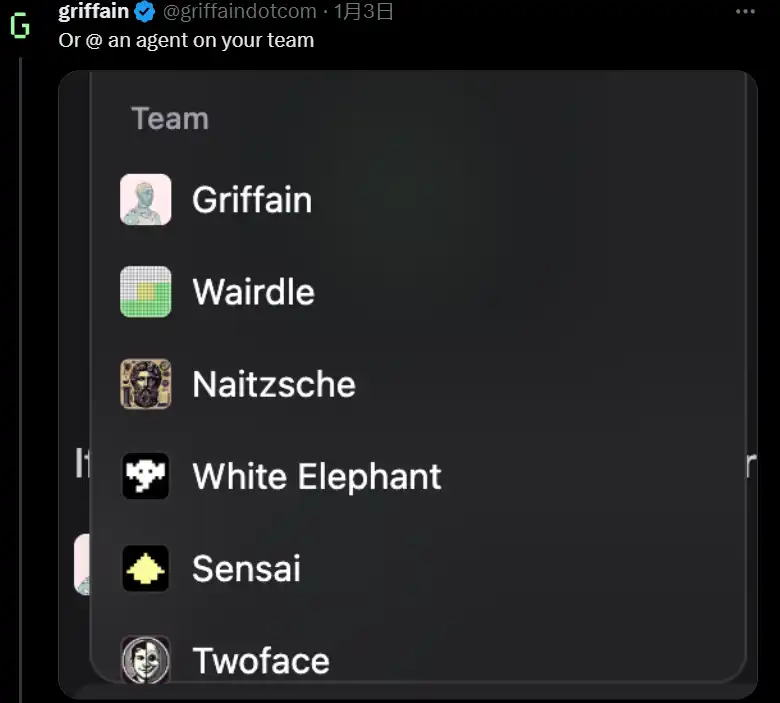

Griffain is a new AI Agent built on the Solana blockchain. Its design aims to simplify the interaction between users and cryptocurrency by integrating personal and professional AI agents. Griffain can automatically perform tasks such as wallet management, token trading, and NFT minting. It allows users to execute various operations from simple to complex, such as dollar-cost averaging (DCA), launching memecoins, and conducting airdrops.

grift

Grift is an AI agent token launched by the AI infrastructure protocol SphereOne team (backed by Coinbase and Google), making Meme trading even easier. With just one click, users can scan high-volume memes and automatically purchase with GRIFT, saving transaction time and effort. SphereOne is a cross-chain crypto payment platform, and its AI trading tools have been market-validated. Orbit/Grift is the second project to release a token, with a product that aims to enhance the on-chain DeFi experience. Orbit emphasizes cross-chain functionality, as it has integrated over 117 chains and 200 protocols, making it the protocol with the highest integration count among the three.

neur

Similar to Griffain, Neur is an intelligent AI assistant on the Solana blockchain that can provide functions such as creating/checking/managing wallets, Swap/DCA/limit orders, trading NFTs, token analytics, popular tokens, token recommendations, creating and sharing Blink-issued tokens, and more. Neur is the third project to launch a token, but due to its open-source nature, it quickly surpassed Orbit in valuation. Neur positions itself as Solana's co-pilot, designed specifically for the Solana ecosystem. Neur is supported by sendaifun's Solana Agent Kit.

Buzz

Buzz is a platform that helps users easily navigate DeFi, acting like a super-intelligent bee specialized in handling transactions, staking, borrowing, and other complex DeFi operations. Users only need to tell it what they want to do through chat commands, and it will automatically execute the task. It can also combine different needs into customized strategies. For example, setting conditions to trigger automatic actions based on price fluctuations. The platform also supports developers to add new features.

Trading

From capturing alpha through information mining to manually executing trades and optimizing portfolios based on indicators, achieving rapid, efficient, and strictly planned execution is a highly challenging and counterintuitive task for a human trader. However, for an AI agent, all it takes is one command to perform perfectly. Autonomous trading agents have taken trading bots to a new level, as they can adapt, learn, and make smarter decisions over time.

Trading bots are not a new concept, but AI agents and trading bots have fundamental differences. AI agents can extract information from a constantly changing environment, continually optimize their models based on market data, and ultimately execute instructions for maximizing returns without explicit programming from their owners.

Kira

Kira is an AI agent for hedge fund managers. It analyzes the market, predicts trends, and optimizes strategies. Kira uses historical market trading data to train and optimize its models, can analyze the cryptocurrency market to determine the best delta-neutral trading strategy, prioritizes strategies with high Sharpe ratios to achieve maximum returns, and implements automated stress testing protocols and market simulations for comprehensive risk management across different market scenarios.

ASYM41b07

ASYM is a project aimed at generating profit and returning it to the $ASYM agent network. The first real-time agent on the ASYM infrastructure monitors the pumpdotfun token, analyzes trends, and executes trades using a price prediction model.

ProjectPlutus

Project Plutus provides a reliable AI agent trading partner that utilizes real-time data for analysis and executes Dollar-Cost Averaging (DCA), integrated with the sendaifun Solana AI Agent Kit. In addition to basic trading strategies and target inclinations, future plans include the ability to review open-source or on-chain contracts if feasible. Automation along with token analysis and fraud detection will give the trading strategy an edge over other projects in the blockchain dark forest.

Almanak

Almanak is an agent-centric platform that allows users to build, train, and manage financial strategies using AI agents. It provides users with institutional-grade quantitative AI agents, addressing the complexity, fragmentation, and execution challenges in DeFi. Almanak's infrastructure supports the creativity, creation, evaluation, optimization, deployment, and monitoring of financial strategies, with the ultimate goal of enabling these agents to learn and adapt over time.

Almanak raised $1 million on legiondotcc, with oversubscription. The next steps include the release of a beta version and the initial deployment of strategies/agents for testing by beta testers. Observing the performance of these quantitative agents will be very interesting.

C.A.T

An autonomous, learning, and trading-executing AI trader aiming to redefine DeFAI. As an AI agent on the Boltrade DEX, C.A.T focuses on tracking and analyzing the top 1,000 wallets, monitoring all on-chain activities, and sharing the latest market dynamics and investment insights on social platform X. C.A.T will serve as the virtual brand image of Boltrade, helping users discover potential high-quality projects.

Cod3xOrg / BigTonyXBT

Cod3x is an infrastructure that combines DeFi and AI, providing a no-code building tool to create automated DeFi strategy agents. BigTony is the first self-governing trading agent to access Cod3x, AlloraNetwork, and HyperliquidX.

AI-Driven dApps

AI-driven dApps are a promising but nascent field within DeFAI. These are fully decentralized applications that integrate AI or AI agents to enhance functionalities, automation, and user experience. While this field is still in its early stages, some ecosystems and projects have started to stand out.

mode

Within this space, modenetwork is a highly active ecosystem, with Mode L2 expanding DeFi to billions of users through on-chain agents and AI-driven financial applications. Mode serves as a hub for multiple teams working on cutting-edge AI-driven applications:

ARMA: The ARMA Agent automatically discovers optimal USDC yields from Mode Network's prominent lending protocols.

Modius: By providing an initial investment asset, Modius intelligently invests crypto assets in DEX.

Amplifi Lending Agents: Developed by Amplifi Fi, these agents integrate with IroncladFinance to automatically swap assets, lend on Ironclad, and maximize returns through automated rebalancing.

At the core of this ecosystem is the MODE token. Holders can stake MODE to earn veMODE, allowing them to receive airdrops from AI agents, whitelist access to projects, and other ecosystem benefits. Mode is positioning itself as a hub for AI x DeFi innovation, with its impact expected to grow significantly by 2025.

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Untitled

I’m sorry, but without content to rewrite, I’m unable to produce an article within the specified word count…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

$30 Million Heist: Step Finance Treasury Wallets Breached

Key Takeaways Step Finance, a prominent Solana-based DeFi platform, faced a significant security breach, losing approximately $30 million…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…