When the Prediction Market Shifts from 'Predicting' to 'Revealing the Truth': Delphi Officially Launches Prediction Market Coverage

For a long time, we have understood prediction markets as a very “rational” activity: people bet on the future based on public information, and market prices reflect consensus. However, over the past year, we have increasingly realized one thing: many prediction markets are not about “predicting the future” but about preemptively exposing those “results already known to a few.”

When an outcome is already certain but not yet public, the prediction market becomes an extremely brutal entity: it doesn't need leaks, anonymous tips, or even a single word. The flow of funds itself is the leak.

The Prediction Market is Changing the Nature of “Secrecy”:

Imagine a few scenarios:

· A hit TV show has finished filming, will the main character die?

· The selection process for a gaming award has mostly concluded, but the results are not yet announced

· An AI company is about to release crucial product or acquisition news

· Regulatory outcomes for a Crypto protocol, listing times, governance vote direction

In the traditional world, these are called “inside information.” But with the advent of prediction markets, they face a new challenge: as long as someone knows and can place a bet, it is challenging for the secret to avoid market capture. You don't need to know “who said what,” you just need to look at:

· Which options are disproportionately staked

· Which addresses are consistently betting at key times

· Which accounts repeatedly “correctly bet early” in similar events

This is not a conspiracy theory; it is a natural outcome of probability and incentives.

From “Content Reporting” to “Result Stress Testing”

This is also why we are starting to rethink the traditional news model. The previous content logic was: event occurs → a few know → report (publish) → public knows

However, the prediction market brings another path: event occurs → someone knows → someone bets → price starts to deviate → the world already “knew in advance”

There is even a more extreme path: event occurs → someone knows → someone bets → price starts to deviate → leading to a change in the event

Regarding this path, I can provide a classic example: at the end of Coinbase's (Nasdaq: COIN) Q3 2025 earnings call, CEO Brian Armstrong said a seemingly offhand remark:

“I got a bit sucked into a prediction market. I've been tracking a prediction market on what we would say on this earnings call... So, I have to get these words in before the call ends: Bitcoin, Ethereum, blockchain, staking, and Web3.”

These words were not random but were part of a prediction market where people bet on whether certain words would be mentioned during this earnings call. After Armstrong said this sentence, the relevant prediction markets settled immediately, and those who bet on the words being spoken correctly profited. Reportedly, there was around $80,000 in bets settled instantly on platforms like Kalshi and Polymarket.

In other words, without these bets, in another parallel universe, Brian Armstrong would have just gone through the earnings call process normally without intentionally saying these words. This is the "reality-distortion field" of prediction markets, where the act of betting itself has the power to alter reality. This phenomenon is common in sports betting, where outcomes are often manipulated due to insider control to favor the least bet-upon option. However, whether it's words spoken during a Coinbase earnings call or a football match, these events have minimal impact on our world. But with platforms like Polymarket and Kalshi growing, these topics will be closer to our everyday lives, and this "reality-distortion field" of prediction markets will increasingly affect our lives.

In the future, content will no longer be the starting point for information but a tool for validation and interpretation. In extreme cases, content can even change reality. This is what the BlockBeats prediction market report is doing: it's not a "prediction market guide" or a mere recounting of what happened on Polymarket and Kalshi.

What we truly care about are three things:

· Which events show odds changes that are not primarily driven by emotion or public information?

· Are there addresses consistently heavily betting on the "winning" outcome before results, with an unusually high historical accuracy rate?

· Do these behaviors point to some "known but undisclosed" facts?

We achieve this through analyzing:

· Topics and option odds in prediction markets

· Bettors' on-chain addresses and their associated behaviors

· Similar betting patterns in past events

to do one thing: treat the prediction market as a "covert stress-tester" rather than a mere opinion poll.

Currently, we are focusing on several key areas:

· Macro policy directions and geopolitics that can impact the capital markets

· AI Industry: Product release timings, acquisitions, key personnel changes

· Crypto Industry: Token Generation Events, regulations, governance outcomes, significant protocol changes

The Future of the Content Industry:

The real challenge of prediction markets is not accuracy, but rather that they are undermining a long-standing default order in the content industry and regulation: only information allowed to be spoken out will become "common knowledge." When everything is open for betting, secrets are will no longer be constrained by institutions, professional ethics, or news censorship but will instead continue to battle against the price discovery mechanism.

In a mild scenario, this means that the endings of TV series, award recipients, and business decisions will be known in advance by the market; while in an extreme scenario, it may even involve war and geopolitical conflicts: people can obtain "military intelligence" level information through bets made by soldiers on the war frontlines, directly influencing the course of the war. When the outcome is already known to a few, and the market allows betting around the outcome, the price itself may become an undeniable signal of reality.

The first time I felt awe towards the financial industry was when I read a story in college about Ray Dalio, the founder of Bridgewater Associates, who had helped McDonald's hedge chicken futures in his early years; in the United States, large restaurant chains almost always hedge their core raw materials synchronously with futures to withstand the drastic price fluctuations, ensuring that consumers can enjoy consistent quality and price-controlled McNuggets at any time. What made me awe-inspiring is not the later achievements of Dalio, but the first time I clearly realized: the original intention of the financial market's birth was never for trading itself, but to make the real world operate more stably and predictably.

The futures market helps people hedge commodity price risks, the stock market helps socially valuable enterprises finance and develop more efficiently; in this process, the participation of traders and speculators provides liquidity, farmers lock in future revenue in advance, and companies obtain a stable cost structure. Although market participants take what they need, the overall system is a long-term positive-sum game.

This also forces us to return to a more fundamental question: when such massive speculative liquidity as Polymarket already exists, is it possible to guide it towards more directions that truly generate positive EV? If an event, once it occurs, will have a significant impact on individuals' lives, assets, or decisions, do we have the opportunity to leverage the liquidity of prediction markets, and even evolve in the form of a combination of multiple markets into an "event insurance"-like product, similar to the "flight delay insurance" we have in our lives now, which, although cannot compensate for our flight delay losses, can provide people with some psychological comfort.

Prediction markets are not challenging a particular media outlet, but are questioning a larger issue: when the world begins to be bet on, who still has the power to decide "what can be known?" and "when can it be known?" We will continue to explore this path. In addition, the BlockBeats Prediction Market Analysis team has also been established, if you also love content and are curious about prediction markets, you are always welcome to join us. (Resumes can be sent to contact@theblockbeats.org or HR telegram @Jhy10vewh0 with the note "Prediction Market") We also welcome startup teams in the prediction market and AI-related fields to discuss with us. BlockBeats is committed to giving excellent startup teams maximum exposure to the best of its ability, contact email contact@theblockbeats.org

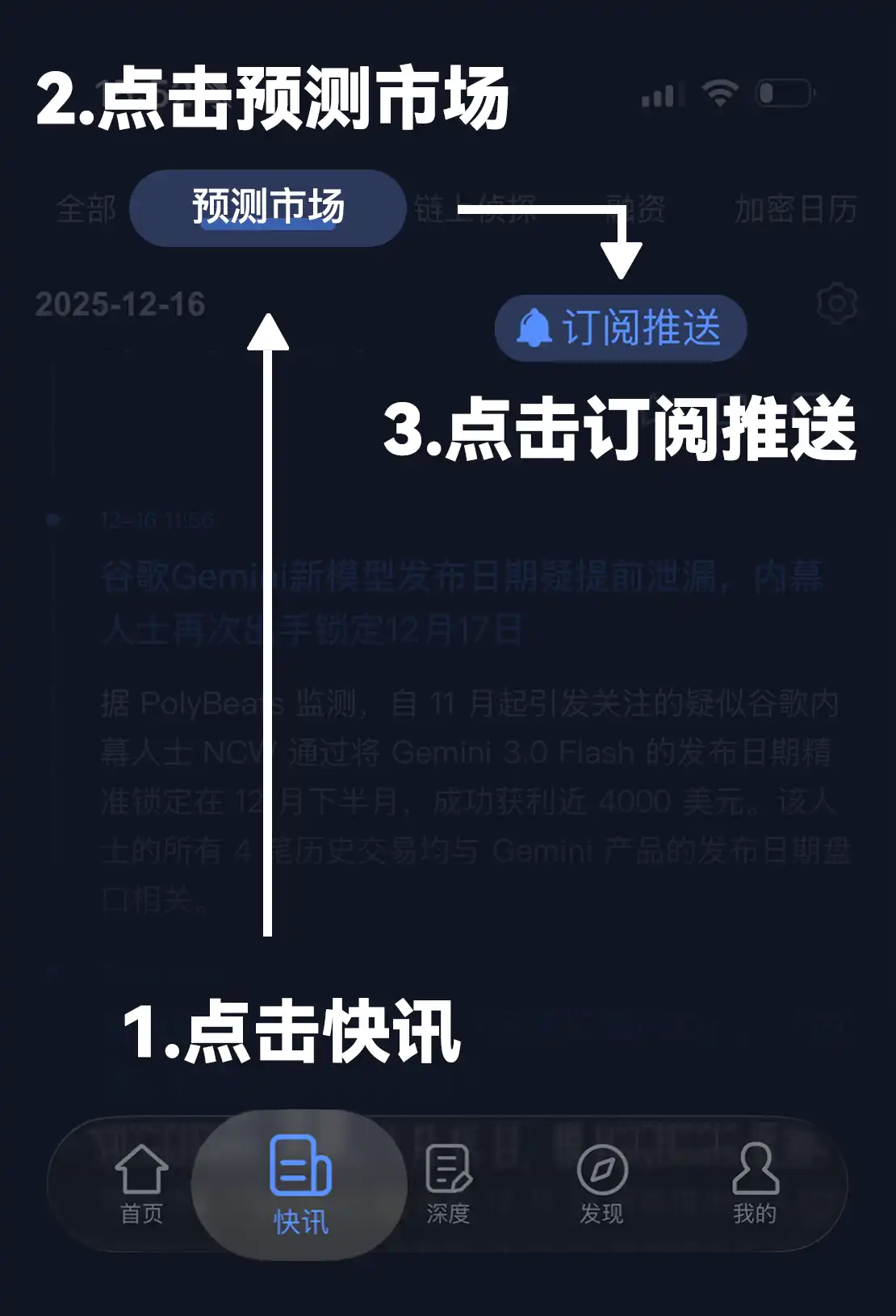

Finally, if you would like to receive timely updates on the prediction market news we uncover, you can subscribe on the Lydian APP. After subscribing, you will receive real-time prediction market news via in-app notifications. The specific steps are as shown in the image below (please make sure your APP is up to date).

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

Bitcoin’s 7% Drop to $77K Might Indicate Cycle Low, Analyst Suggests

Key Takeaways: Bitcoin has experienced a significant drop from $77,000 to around $78,600 after a modest rebound. Analyst…

US Court Sentences Chinese National to Nearly Four Years for $37M Crypto Fraud

Key Takeaways Jingliang Su, a Chinese national, received a nearly four-year prison sentence for laundering over $36.9 million…

Tom Lee–Linked Bitmine Faces Over $6B in Unrealized Losses on ETH Reserve

Key Takeaways: Bitmine Immersion Technologies reports significant unrealized losses exceeding $6 billion from its Ether reserves. The firm…

Silver Suffers Record 36% Drop as Precious Metals Crash – Is Bitcoin Primed for a Rally?

Key Takeaways Silver and gold undergo a historic collapse due to geopolitical and technical influences, culminating in significant…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…